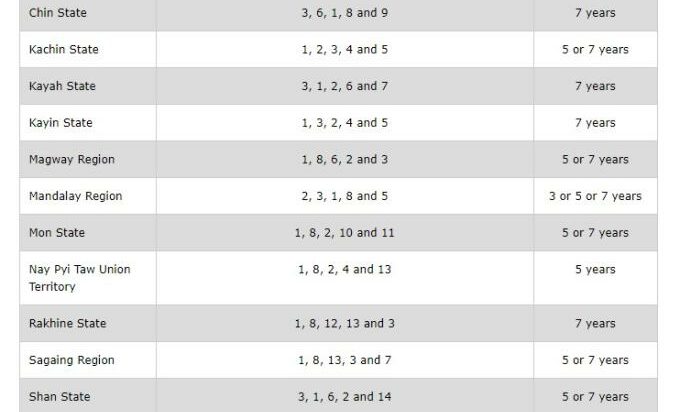

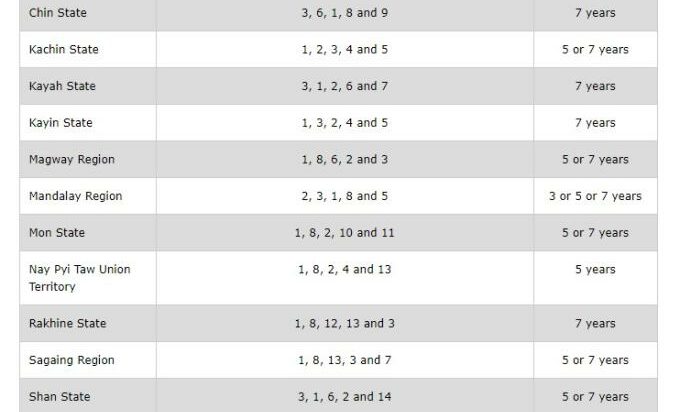

The Ministry of Investment and Foreign Economic Relations (MIFER) has announced the priority investment sectors for each of the country’s 14 states and regions, as well as the capital Naypyidaw which is designated as a Union Territory.

Each administrative division has been assigned five priority business areas, which are drawn from a list of 14 priority investment sectors – agriculture, manufacturing, hotels and tourism, logistics, real estate, power, natural resources and mining, livestock, urban development and development of industrial zones, healthcare, eco-tourism, education, infrastructure and transportation, and IT services.

Investors in any of the five designated priority sectors in the relevant administrative division are to be exempted from Corporate Income Tax (CIT) for periods ranging from three to seven years. For example, companies who invest in manufacturing, infrastructure and transportation, IT Services, hotels and tourism, or education in the Yangon Region (which includes the country’s commercial capital and largest city Yangon) won’t have to pay CIT for either three or five years. Similarly, investors in the Mandalay Region (which includes the country’s second-largest city Mandalay) will be able to claim exemption from CIT for three, five or seven years if their projects fall within any of the region’s five priority sectors – manufacturing, hotels and tourism, agriculture, livestock or real estate.

Priority investment sectors of each administrative division, and the periods for which exemption from CIT applies:

Source:

HKTDC